Why we choose hard problems over easy markets

Most investors passed on Atomic Alchemy because it was a nuclear reactor. Full stop. While they chased software margins, we saw a founder living inside the biggest bottleneck in nuclear.

The Constraint Nobody Wanted

The nuclear medicine market in 2019 was broken: only 7 aging reactors worldwide produced medical isotopes—none of those in the US. The US imported over 90% of its materials from foreign reactors nearing end-of-life. Research hospitals would regularly contact Idaho National Lab desperate for isotopes that didn't exist.

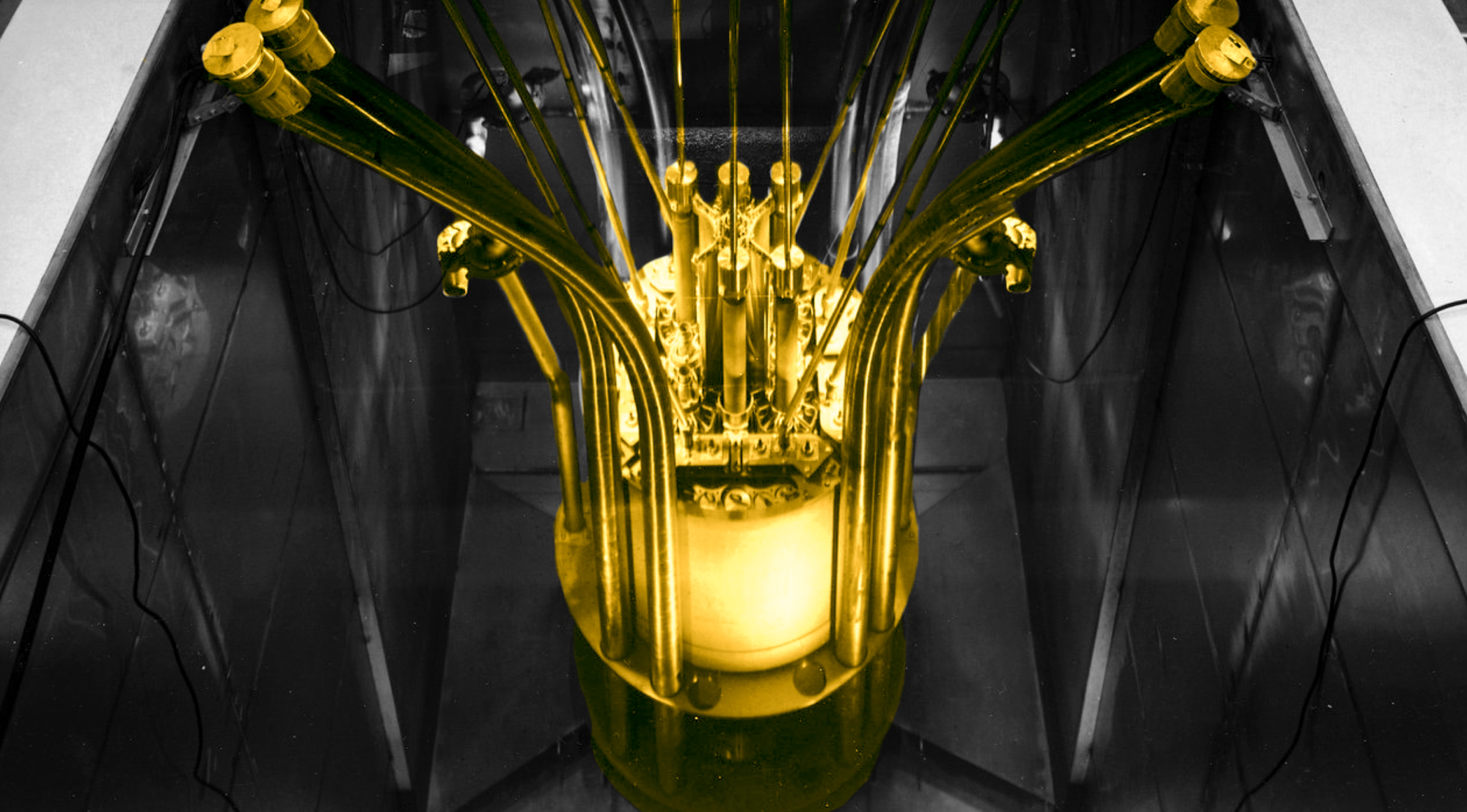

Thomas Eiden was the lead reactor engineer there, integral to getting materials irradiated in the reactor and designing the reactor core for each operational cycle. Through hundreds of stakeholder conversations—customers, researchers, and industry players—he realized this wasn't just a medical isotope shortage. Every emerging nuclear application—from advanced reactors to space batteries to fusion—hit the same wall: fuel supply. Thomas identified a pathway others had missed to unlock an entire nuclear renaissance.

The Exit That Proved It

In late 2024, Oklo acquired Atomic Alchemy. The acquisition came five years after our initial investment, validating both our timeline and thesis. The logic was compelling: Oklo needs fuel so badly that they're taking on the behemothic task of commercializing nuclear fuel reprocessing. Atomic Alchemy's ability to recycle the waste products from Oklo's fuel recycling process both generates revenue and brings down the cost of their waste disposal.

This ties directly back to those stakeholder conversations Thomas had years earlier. The materials Atomic Alchemy would recycle could drive the same use cases that desperately needed fuel supply—creating value from what others saw as waste.

We hadn't just backed a nuclear startup—we'd backed the critical infrastructure other nuclear companies would need.

Why We Saw It Differently

The rejections from other investors were predictable: "Too regulated." "Capital intensive." "Nuclear is risky."

These missed the point. Every investor focused on building complexity while Thomas focused on operating economics. Others saw regulatory hurdles—he saw relationships cultivated over years. Others worried about market size—he had desperate stakeholders with letters of intent spanning multiple disparate industries.

The difficulty wasn't a bug—it was a feature. High barriers meant sustainable advantages for whoever could execute. Thomas had the regulatory relationships, line of sight toward non-dilutive funding pathways to finance the lion's share of the capex, and years of reactor operations experience.

When nuclear became cool in 2021, everyone chased fusion and fission energy plays. We bet on nuclear production 2-years before that. Energy markets are complex and political. Medical isotope production, on the other hand, is straightforward: hospitals need isotopes, isotopes decay quickly, nobody else makes them domestically—this was Atomic Alchemy's wedge.

The Pattern: Non-Consensus Clarity

We look for massive demand artificially constrained by infrastructure or regulation. Then we back founders who can systematically remove those constraints rather than work around them.

Thomas didn't just see a medical isotope shortage. He identified the fundamental constraint limiting an entire nuclear renaissance. Solving it wouldn't create just a business—it would unlock an ecosystem.

Most investors optimize for simplicity. We optimize for solvable complexity. When everyone else sees the same obstacle, that's where opportunity lives.

Illegibility is alpha. We back the weird ones that just might work.

Think you're building something impossible? We're built for edge cases that consensus skips over.